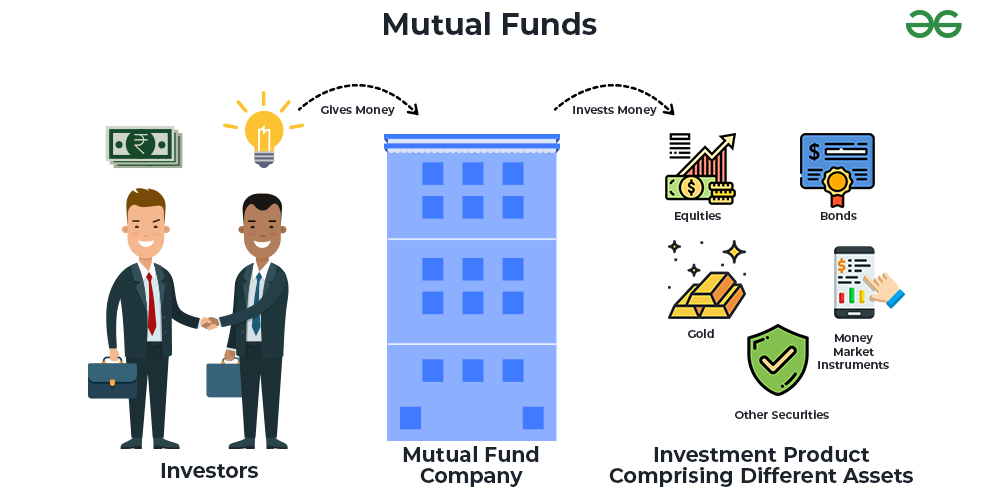

Mutual funds serve as popular investment vehicles that pool money from numerous investors to invest in a diversified portfolio of securities, managed by professional fund managers.

These funds are categorized based on various factors, offering investors a range of options tailored to their preferences and financial goals. The pooling of resources allows investors to own units or shares in the fund, with the overall goal of achieving broader market exposure and risk reduction through diversification.

Mutual funds come in various types, including equity funds, bond funds, balanced funds, and money market funds, catering to different investment preferences and risk tolerances. Mutual funds hold significant importance in the financial landscape due to their role in offering investors a diversified and professionally managed investment approach.

Advantages of Mutual Funds

- Diversification: Mutual funds pool money from various investors to invest in a diversified portfolio of securities.

- Professional management: Mutual funds are managed by professional fund managers who conduct in-depth research and analysis. Their expertise allows for informed investment decisions, potentially maximizing returns.

- Liquidity: Open-ended mutual funds provide liquidity, allowing investors to buy or sell units at the Net Asset Value (NAV) at any time. This flexibility is beneficial for those needing access to their funds quickly.

- Affordability: Mutual funds allow investors to participate in a diversified portfolio with a relatively small investment amount. This makes them accessible to a wide range of investors.

- Variety of Options: Mutual funds offer various options, catering to different risk appetites, investment goals, and time horizons. Investors can choose funds that align with their preferences.

Types of Mutual Funds

The different types of mutual funds available can be classified broadly based on structure, asset class, and investment goals. Going a step further, funds can also be categorized based on risk.

1. Based on Structure

Mutual funds can be categorized based on their structure, which refers to the rules and features that govern how investors can buy and sell shares in the fund. The main types based on structure are open-ended, close-ended, and interval funds.

- Open-ended Mutual Funds: Open-ended mutual funds are the most common type. These funds do not have a fixed number of units and continuously issue and redeem shares based on investor demand. This makes them highly liquid investment options.

While most open-ended mutual fund schemes are open for subscription and redemption, there are exceptions like Equity Linked Savings Schemes (ELSS) and certain solution-oriented schemes, which come with lock-in periods. In ELSS, redemptions are restricted, and solution-oriented funds may have lock-in periods extending up to 5 years.

- Close-ended Mutual Funds: Close-ended mutual funds have a fixed number of units issued through a New Fund Offer (NFO).

After the NFO, the fund is closed for new investors, and the units can be traded on the secondary market.

Investments are restricted to this initial offer period, and redemptions are set for a specific future date. Following the NFO, some closed-ended funds may be traded on stock exchanges, providing investors an opportunity for secondary market transactions.

Additionally, these funds often offer periodic repurchase options, allowing investors to sell their units back to the mutual fund company. As per SEBI regulations, mutual fund companies are required to provide an exit route for investors, either through sale on the stock exchange or repurchase by the company. - Interval Mutual funds : Interval funds combine features of both open-ended and close-ended funds. They allow investors to buy or sell units at specific intervals, such as quarterly or semi-annually. Investors have limited liquidity compared to open-ended funds but more flexibility than close-ended funds

Also, Fund managers may have more flexibility in managing the portfolio due to the periodic intervals for redemptions and purchases.

2. Based on Asset Class

Mutual funds can be categorized based on the assets in which they invest. The primary asset classes include equity (stocks), debt (bonds and fixed-income securities), commodity funds (gold and silver) and a combination of equity and debt known as hybrid funds. Here’s an overview of mutual funds based on asset class.

- Equity Mutual Funds: These funds primarily invest in stocks or equities. The goal is capital appreciation, and returns are derived from the appreciation in the value of the stocks held by the fund.

Equity mutual funds primarily invest in a diverse range of company stocks, with returns dependent on the stock market performance. These funds carry higher risks but also offer the potential for substantial returns.

In line with SEBI regulations, equity funds are required to allocate at least 65% of their assets to equities. They often focus on specific market capitalizations, exemplified by various schemes like large-cap, mid-cap, large and mid-cap, and small-cap funds.

- Debt Mutual Funds:Debt funds invest in fixed-income securities such as government and corporate bonds. The primary objective is to generate regular income through interest payments. They are ideal for those seeking short-term investment avenues.

Compared to equity funds, debt funds typically offer more stable returns, positioning them as lower-risk investments. However, it’s important to note that debt funds are not risk-free and are subject to credit and interest rate risks.

- Hybrid Mutual Funds: Also known as balanced funds, hybrid funds invest in a mix of both equity and debt instruments. The allocation between equity and debt varies based on the fund’s objective. Hybrid funds invest in a mix of both debt and equity, offering the dual benefits of asset allocation and portfolio diversification.

Their strategy is to balance long-term capital growth through equity investments with short-term stability and consistent income from debt instruments. The equity component aims to increase potential returns, while the debt portion provides a buffer against significant market fluctuations, thus overall reducing the portfolio’s risk.

Hybrid funds come in various types, each with a distinct balance of debt and equity, including multi-asset allocation funds, aggressive hybrid funds, and balanced advantage funds.

3. Based on Investment Goal

Mutual funds are categorized based on specific investment goals that investors may have. The primary investment goals for mutual funds include growth, income, and capital protection. Here’s an overview of mutual funds based on investment goals:

- Growth Funds: Growth funds, as the name suggests, aim for capital appreciation over the long term. These funds invest in stocks of companies with high growth potential. Suited for investors with a long-term investment horizon, a higher risk tolerance, and a goal of building wealth over time. At the same time, Growth funds are associated with higher risk due to their focus on equities, but they also offer the potential for higher returns.

- Tax-Saving Funds (ELSS): Tax saving funds, also known as Equity Linked Savings Schemes (ELSS), aim to provide tax benefits and primarily invest in equities. ELSS funds carry market risks associated with equities but come with a lock-in period. They offer the potential for capital appreciation and tax savings.

- Liquidity-based funds: For short-term financial goals, ultra-short-term and liquid funds offer high liquidity. Conversely, retirement funds and similar schemes have longer lock-in periods for long-term planning.

- Capital Protection Funds: Capital protection funds prioritize safeguarding the invested capital. These funds typically allocate a significant portion of assets to low-risk instruments like government bonds. They allocate investments between fixed-income instruments and equities, aiming to protect the principal amount while offering taxable returns.

- Fixed-Maturity Funds: Fixed maturity funds, also known as fixed maturity plans (FMPs), are a type of debt mutual fund offered by asset management companies.

These funds have a specific maturity date, which distinguishes them from other open-ended debt funds. The investment horizon of fixed-maturity funds is predetermined, typically ranging from one month to five years or more. - Pension Funds: Pension funds are investment funds that manage and accumulate capital to provide income for individuals during their retirement years.

These funds are created by employers, government entities, or labour unions to ensure that employees have a source of income after they retire. The primary goal of pension funds is to generate returns on investments, allowing them to pay pensions and other retirement benefits to the fund’s participants.

Understanding these different investment goals helps you choose mutual funds that align with your specific financial objectives, risk tolerance, and time horizon. A well-diversified portfolio often includes a mix of funds based on different investment goals to achieve a balanced and customized approach to wealth creation.

4. Based on Risk

Mutual funds can also be categorized based on their risk profile, which is crucial for investors to match their risk tolerance with the fund’s characteristics. The main types based on risk are high-risk funds, low-risk funds, and moderate-risk funds.

- High-risk: High-risk mutual funds, often associated with equity funds, aim for aggressive capital appreciation. These funds invest in stocks of companies with high growth potential. High-risk funds come with the potential for significant returns, but they are also subject to higher volatility and market fluctuations. Investors may experience substantial gains or losses.

- Low-risk: Low-risk mutual funds, often associated with debt funds or money market funds, prioritize capital preservation and stability. These funds invest in fixed-income securities with lower volatility. Low-risk funds provide more stable returns but typically offer a lower potential for capital appreciation compared to high-risk funds. They are suitable for conservative investors prioritizing safety over aggressive growth.

- Moderate-risk: Moderate-risk mutual funds, often associated with balanced or hybrid funds, seek to balance capital appreciation and income generation.

These funds invest in a mix of equities and fixed-income securities. Moderate-risk funds aim to provide a middle ground, offering a balanced mix of potential for growth and income. They provide a more diversified approach to managing risk. - Risk-adjusted: risk-adjusted funds focus on optimizing returns based on a predefined level of risk. These funds aim to deliver the best risk-adjusted performance, considering factors such as volatility and downside protection.

Understanding the risk profile of mutual funds is crucial for you to build a diversified portfolio aligned with their risk tolerance and financial goals. It’s common for investors to hold a mix of high, low, and moderate-risk funds to create a well-balanced and personalized investment strategy.

Investing in mutual funds can be a powerful tool for wealth creation, but it’s not without its complexities. we’ll address some common concerns head-on,and emphasize the importance of a long-term perspective:

Navigating the Risks

- Market Risk: The overall market fluctuates, and your fund’s value will follow suit. Diversification across asset classes helps mitigate this, but there’s no guarantee of immunity.

- Fund-Specific Risk: The fund’s performance depends on the underlying holdings. Research a fund’s track record and investment strategy before investing.

- Liquidity Risk: While most mutual funds are relatively liquid, selling them might incur exit loads or take some time depending on the fund type.

The Power of Long-Term Investing

- Compounding: Reinvesting earnings amplifies your returns over time. The earlier you start, the greater the compounding effect.

- Time Horizon: Long-term investing allows you to ride out market cycles and potentially benefit from overall market growth.

- Discipline: Resist the urge to react impulsively to market noise. Stick to your plan and avoid emotional decisions

Start Your Investment Journey

Investing in mutual funds can be a rewarding journey, but it’s not without its challenges.

Considering the intricacies of wealth management and the complexities of financial markets, seeking a professional Financial investment service can be instrumental in securing your financial future.

By understanding the risks, fees, and importance of a long-term perspective, and drawing inspiration from success stories, you can chart your path to financial success.

Do you need personalized assistance for your investment journey? Explore Moolaah, an all-in-one solution for your investment and asset distribution