Invest in Mutual funds

with Moolaah

Free Service | Higher returns | Increased Wealth

Why Invest with Moolaah?

Moolaah is an online investment platform designed to help you achieve your financial goals with expert guidance.

Open Your Account

Get started with a free, paperless account in just 5 minutes.

Choose Your Distributor

Select an expert mutual fund distributor from our Moolaah Partner network.

Discuss Your Goals

Select an expert mutual fund distributor from our Moolaah Partner network.

Explore & Select

Investment Options

Choose investment products that best fit your financial goals with your Partner’s guidance.

Track Performance

Manage and analyze your portfolio’s performance with support from your Moolaah Partner.

Why Invest in Mutual Funds

Invest from as Low as ₹100

Start your investing journey with

just ₹100.

Save up to ₹46,800

Get tax benefits of up to ₹46,800 with schemes like ELSS.

Multiplying Wealth

through Compounding

Grow your wealth over time with the power of compounding.

Automated Investment

through SIP

Invest regularly and automatically with Systematic Investment Plans (SIPs).

Professional Fund Management

Benefit from the expertise of professional fund managers.

Effortless Investment Setup

Benefit from the expertise of professional fund managers.

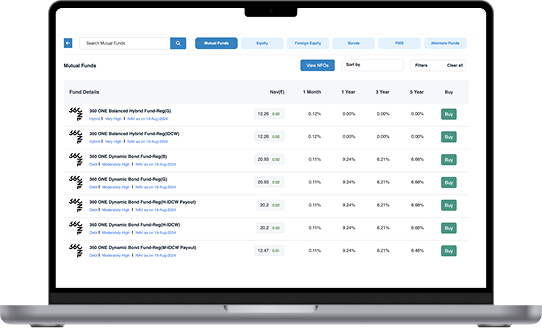

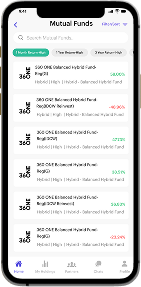

Top Mutual Funds to Invest

Debt funds primarily invest in fixed-income securities such as bonds, treasury bills, and commercial papers. These funds aim to provide regular income and capital preservation by generating returns through interest income and capital gains.

Debt mutual funds are Ideal for Investors

- Seeking stable returns with lower risk- suitable for those wanting to preserve capital and earn steady income.

- With flexible investment horizons- ideal for both short-term (1 month) and medium term(up to 5 years) investments.

- Risk-averse but aware of interest and credit risks- generally lower risk than equity funds, but still subject to interest rate and credit risk.

Debt funds primarily invest in fixed-income securities such as bonds, treasury bills, and commercial papers. These funds aim to provide regular income and capital preservation by generating returns through interest income and capital gains.

Debt mutual funds are Ideal for Investors

- Seeking stable returns with lower risk- suitable for those wanting to preserve capital and earn steady income.

- With flexible investment horizons- ideal for both short-term (1 month) and medium term(up to 5 years) investments.

- Risk-averse but aware of interest and credit risks- generally lower risk than equity funds, but still subject to interest rate and credit risk.

Debt funds primarily invest in fixed-income securities such as bonds, treasury bills, and commercial papers. These funds aim to provide regular income and capital preservation by generating returns through interest income and capital gains.

Debt mutual funds are Ideal for Investors

- Seeking stable returns with lower risk- suitable for those wanting to preserve capital and earn steady income.

- With flexible investment horizons- ideal for both short-term (1 month) and medium term(up to 5 years) investments.

- Risk-averse but aware of interest and credit risks- generally lower risk than equity funds, but still subject to interest rate and credit risk.

Debt funds primarily invest in fixed-income securities such as bonds, treasury bills, and commercial papers. These funds aim to provide regular income and capital preservation by generating returns through interest income and capital gains.

Debt mutual funds are Ideal for Investors

- Seeking stable returns with lower risk- suitable for those wanting to preserve capital and earn steady income.

- With flexible investment horizons- ideal for both short-term (1 month) and medium term(up to 5 years) investments.

- Risk-averse but aware of interest and credit risks- generally lower risk than equity funds, but still subject to interest rate and credit risk.

Invest in Mutual Funds with Expert Guidance and ZERO Fees

Build your portfolio with Moolaah, enjoying expert support free of cost.

FAQ

A mutual fund pools money from many investors to buy a variety of assets like stocks, bonds, or other investments. Professional fund managers handle the fund, making decisions on where to invest the money.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Moolaah is an independent wealthtech ecosystem, with the aim of delivering a better financial future to individuals and families with the help of Moolaah Partners. The brand is owned by iAltinvest Private Ltd (ARN – 245875).

Mutual Fund investments are subject to market risks, read all scheme-related documents carefully before investing. Historical performance is not indicative of future performance.

Quick Links

Copyright © 2025 Moolaah

Moolaah

Moolaah is an independent wealthtech ecosystem, with the aim of delivering a better financial future to individuals and families with the help of expert advisors.