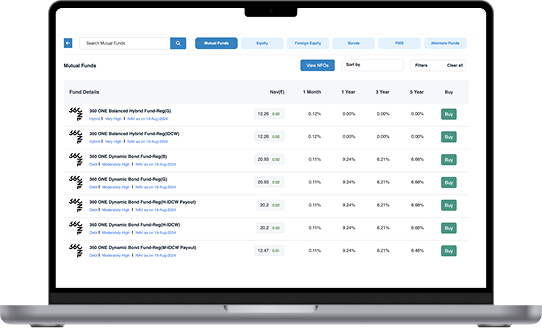

Explore & Select

Investment Options

Choose investment products that best fit your financial goals with your Partner’s guidance.

Track Performance

Manage and analyze your portfolio’s performance with support from your Moolaah Partner.